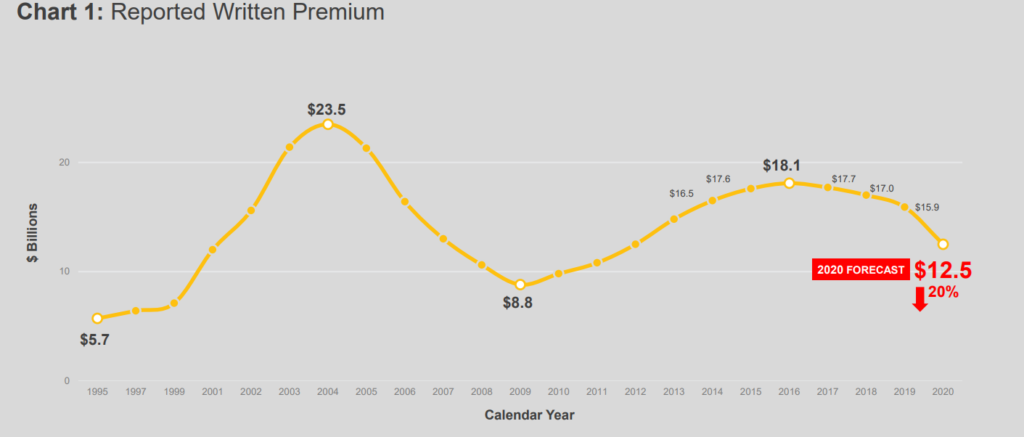

A sharp drop in 2020 workers’ compensation premiums in California is expected with the COVID-19 pandemic-related job losses, a report out today shows.

The Workers’ Compensation Insurance Rating Bureau of California’s 2020 State of the System report paints a picture of a stable workers’ comp market up to the pandemic – and then the proverbial wheels fell off.

“Up to the time of the pandemic things were pretty steady and healthy,” Dave Bellusci, executive vice president and chief actuary of the WCIRB, said in a conference call to discuss the new report. “We are expecting a sharp loss in ’20 with jobs losses coming from the pandemic.”

The WCIRB is expecting a roughly $3.5 billion decline in written premium in 2020, from $15.9 billion in 2019 to $12.5 billion this year.

However, Bellusci acknowledged that the impact of the pandemic on workers’ comp in California has still yet to come into focus.

“The impact of COVID on the market is still not yet clear,” he said.

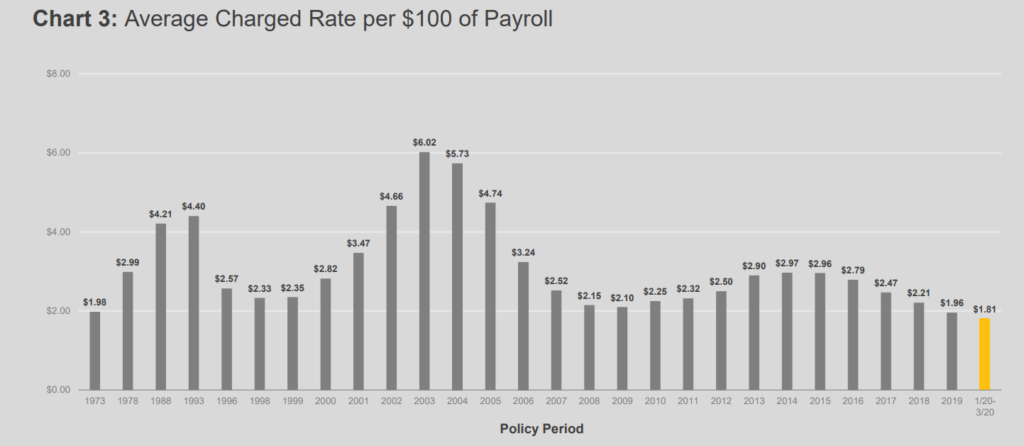

The average charged rates per $100 of payroll fell to $1.96 in 2019 from a peak of $2.97 in 2014. The rate is expected to dip to $1.81 in 2020.

“It’s basically a 50-year low,” Bellusci said.

Workers’ comp reforms and falling claims severity are among the reasons for that trend. But California continues to have high workers’ comp costs relative to other states, ranking as the second most costly state in the U.S. behind New York.

“Still California is a very high cost state,” he added.

The report also examined Gov. Gavin Newsom’s order during the height of the pandemic regarding a rebuttable assumption of compensability for all workers directed by their employer to work outside their home.

“We estimate about 30,000 claims arising during this period generating about $1.2 billion in costs,” Bellusci said.

The WCIRB in June published estimated costs of allowing state workers to receive benefits for COVID-19 claims without proving virus exposure at work, dropping a prior mid-range estimate by $10 billion.

According to Bellusci, recent data from the Division of Workers’ Compensation shows about 15,000 COVID-19 claims so far.

The report shows pre-pandemic cost trends were generally stable with modest frequency and severity growth, continued high levels of frictional costs and significant regional differentials, while 2020 claim frequency could be impacted by the economic downturn and surges of COVID-19 and post-termination claims.

This article was first published by Insurance Journal.